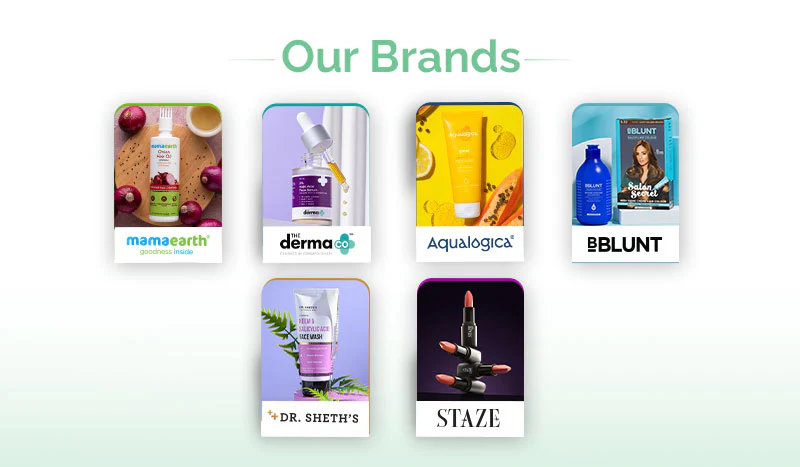

Honasa Consumer—the parent company behind top D2C beauty and skincare India companies like Mamaearth, The Derma Co, and Dr Sheth’s—is breaking into the beauty electronics market as part of a strategic pivot intended at unlocking new revenue channels. This move indicates the company’s intention to expand past its heavy skincare range and ahead in the quickly changing direct consumer scene in India.

Indian D2C updates suggest Honasa is investigating D2C product debuts in high-demand sectors including laser masks, LED light therapy tools, facial rollers, and face massagers—a market already filled by international and domestic players like Panasonic, Philips, and Numour. As its once-flagship brand, Mamaearth, ages and experiences less internet activity, the company’s plan forms part of a bigger effort to revive growth.

According to studies, Honasa is now concentrating its online D2C operations on scaling The Derma Co and Dr Sheth’s, which have continuous high demand in categories including face washes and sunscreens. Meanwhile, Mamaearth is being reoriented with a greater offline emphasis—a vital adaptation as Honasa negotiates structural changes inside its distribution network.

Operating revenue of Honasa totaled ₹2,067 crore in FY25, an 8% year-on–year increase, while net profit dropped to ₹73 crore as a result of offline restructuring. Its younger D2C brands, including Staze in the color cosmetics category, increased over 30% YoY, demonstrating the resiliency and agility of the fastest-growing D2C companies in the portfolio.

Founder and CEO Varun Alagh stressed on Honasa’s postearnings conference that every brand under its portfolio is developing fresh categories supported by product superiority and consumer intelligence. This approach suggests a strategic realignment compatible with current D2C business model trends in India, where innovation is critical for customer stickiness and valuations.

The Indian D2C scene is seeing a marked change toward premium D2C companies investing in beautytech items, therefore matching macro customer trends. IMARC forecasts the Indian beauty appliance market, valued at $1.8 billion in 2024, to explode to $6.8 billion by 2033, so growing at a CAGR of 15.8%. Rising discretionary incomes, social media influence, growing preference for in-home beauty, and demand for multifunctional, tech-led personal care all contribute to the surge.

Entering this sector shows Honasa’s desire to be a varied powerhouse in the D2C industry news environment. Branching into high-margin, technologically driven categories offers a great growth possibility as VC-backed D2C companies are under more pressure to provide sustainable expansion.

Honasa, a topfunded D2C brand running over beauty, skincare, wellness, and now D2C electronics and gadgets, is showing a clear intention to change from its origins and fit India’s evolving D2C consumer behavior.

If successful, this move could position Honasa as a category founder in D2C personal care brands—setting a new standard in how Indian direct-to-consumer companies grow beyond their core while exploiting deep consumer insights—as well as a beauty and skincare leader.