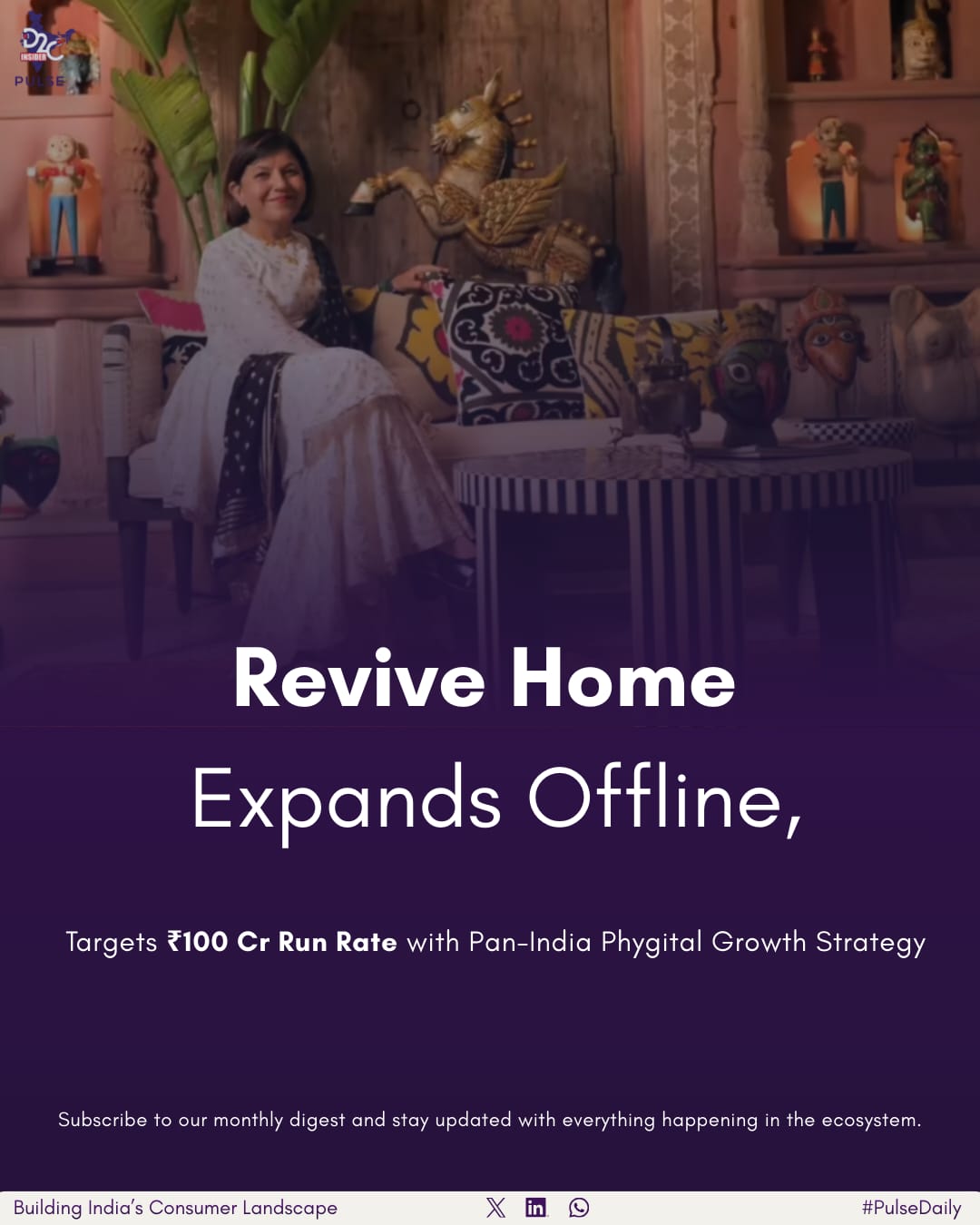

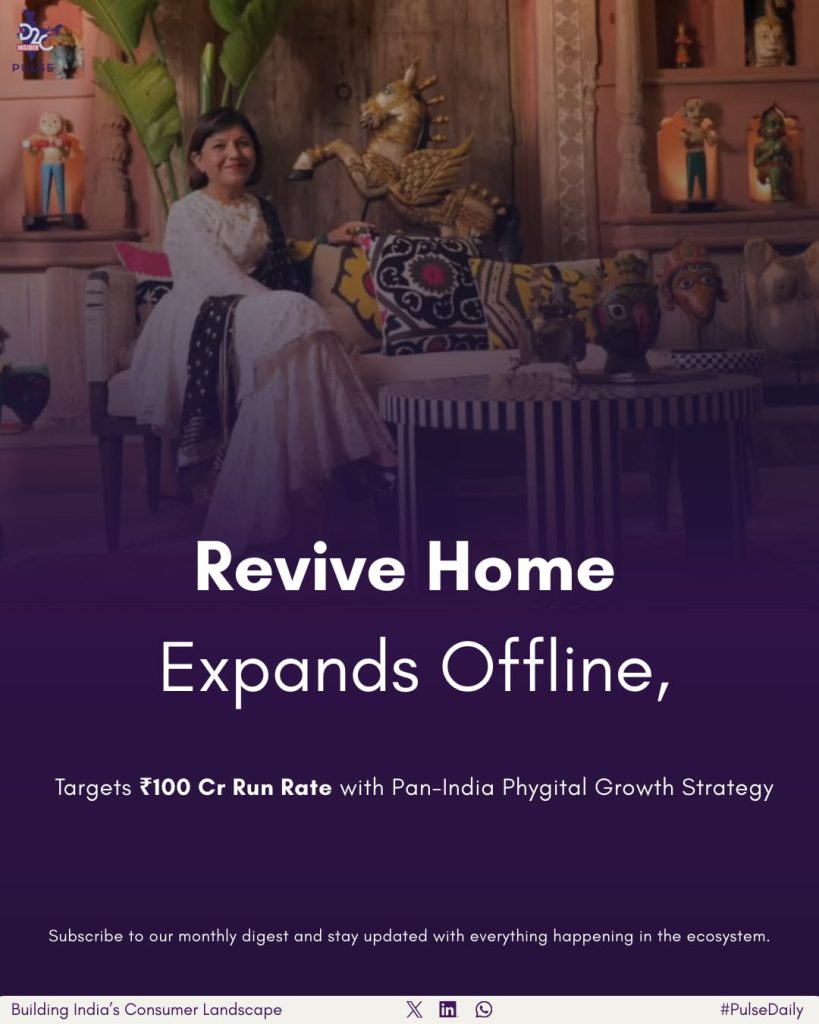

In the latest D2C news India and D2C daily news update, digital-first home décor brand Revive Home has announced its entry into brick-and-mortar retail, marking a pivotal shift in its Direct-to-consumer India growth journey. Known for its handcrafted, antique-inspired furniture and décor, the brand is now adopting a phygital strategy to accelerate scale, strengthen consumer trust, and target a ₹100 crore revenue run rate by the end of FY26–27.

This move reflects broader D2C market trends 2025, where D2C brands India are increasingly blending online strength with offline presence to build credibility in high-ticket categories. For many Latest D2C startups and premium D2C brands India operating in the home and lifestyle segment, physical retail is emerging as a strategic growth lever rather than just a distribution channel. Revive Home’s expansion signals a strong evolution in the D2C business model India, particularly in categories that rely on tactile experience and trust.

In the first phase of its D2C expansion plans, Revive Home will establish an offline presence in Kolkata, Mumbai, and Bengaluru by June 2026. The rollout will begin with four flagship shop-in-shop formats through partnerships with established multi-brand chains. This curated offline model allows customers to physically experience the brand’s handcrafted furniture, intricate woodwork, and artisanal décor rooted in traditional Indian craftsmanship. As part of Indian D2C updates and D2C industry news, such shop-in-shop formats are increasingly being adopted by D2C fashion and lifestyle brands seeking asset-light offline entry.

Sangeeta Vasishta, Director at Revive Home, stated, “Physical retail is the next frontier for scale; it bridges the trust gap for high-ticket artisanal products.” Her statement reflects a larger shift in D2C consumer behavior India, where urban consumers value in-store experience, especially in the premium home décor segment. As India’s home furnishing market expands, customers are seeking authenticity, craftsmanship, and design-led narratives—elements Revive Home positions strongly within the contemporary premium space.

From a financial and growth lens, the brand’s offline push aligns with structured D2C revenue growth ambitions. While the transition to brick-and-mortar retail comes with higher inventory, rental, and operational costs, Revive Home plans to leverage data-driven inventory management to tailor assortments to regional demand. This focus on D2C supply chain innovation and data-backed merchandising reflects evolving D2C go-to-market strategy frameworks. By combining online insights with offline execution, the brand aims to optimise stock turns and improve unit economics.

Within the broader D2C ecosystem India, omnichannel expansion is increasingly seen as a value unlock. For investors tracking D2C funding news, D2C startup valuation metrics, and D2C expansion plans, hybrid retail models offer a pathway to sustainable scaling. While Revive Home has not announced new D2C funding rounds, its structured offline entry demonstrates disciplined capital deployment and long-term growth intent—qualities increasingly valued in D2C business India.

As India’s premium home décor segment evolves, Revive Home’s move underscores what’s happening in India’s D2C space today: digital-native brands are maturing into omnichannel players. By blending craftsmanship with contemporary retail formats, the brand is positioning itself among D2C brands scaling in 2025 and building a replicable phygital model. If executed well, its journey toward a ₹100 crore run rate by FY26–27 could mark a significant milestone in India’s fast-growing Direct-to-consumer India lifestyle ecosystem.